What is time clock rounding?

Time clock rounding is a method used in payroll management that involves rounding employee clock-in and clock-outtimes to the nearest quarter-hour. This practice simplifies the tracking of employee hours worked, making payroll calculations more straightforward and efficient.

In essence, it ensures that employees are paid for the time they genuinely work while avoiding the need to account for every minute.

How does it simplify the payroll process?

Time clock rounding simplifies the payroll process in several ways, ensuring accuracy and efficiency while also considering legal aspects:

-

Precision with nearest quarter hour: By rounding to the nearest quarter-hour, time clock rounding eliminates the need for precise tracking of every minute. For example, if an employee clocks in at 8:07 AM, it's rounded to 8:15 AM, reducing the complexity of payroll calculations.

-

Minimizing errors: The practice minimizes the chances of errors in payroll calculations. With precise rounding increments, such as the nearest quarter-hour, rounding discrepancies are reduced, ensuring that employees are paid fairly.

-

Compliance with labor laws: Time clock rounding takes into account legal considerations, particularly the Fair Labor Standards Act (FLSA). When implemented correctly, it helps businesses maintain compliance with federal labor laws, reducing the risk of wage theft and wage and hour grievances.

Useful Read: Employee Theft: Essential Prevention Strategies for Businesses

Benefits of implementing time clock rounding

Now, let's dive into the benefits that come with implementing time clock rounding:

Improved accuracy in tracking employee work hours:

Time clock rounding ensures that employee work hours are precisely recorded, minimizing the potential for time theft or calculation errors. This accuracy leads to fair compensation for employees.

Reduced administrative burden on payroll personnel:

With time clock rounding, the payroll process becomes more straightforward, reducing the workload for payroll personnel. It streamlines payroll calculations and minimizes the need for manual adjustments.

Enhanced fairness in handling clock-in and clock-out times:

Time clock rounding promotes fairness by treating all employees consistently. It eliminates the need for nitpicking over small time discrepancies and ensures that everyone is compensated fairly for their scheduled working hours.

Compliance with labor laws and regulations:

Implementing time clock rounding helps businesses stay in line with labor laws, including minimum wage and overtime pay requirements. Compliance is crucial for avoiding legal issues and maintaining a good relationship with employees.

Tried-and-true timesheet rounding rules

When it comes to timesheet rounding rules, simplicity and fairness are key. Here are some tried-and-true timesheet rounding rules that businesses commonly implement:

-

Nearest quarter-hour rounding: One of the most widely used rules is rounding employee clock-in and clock-out times to the nearest quarter-hour (15-minute increment). For example, if an employee clocks in at 8:07 AM, their time is rounded to 8:15 AM.

-

Clock-out grace period: Some businesses allow a grace period for clocking out. For instance, if an employee finishes work at 5:08 PM, their time might be rounded back to 5:00 PM to account for a brief delay in clocking out.

-

No rounding for specific breaks: Some rules exclude rounding for specific types of breaks, such as unpaid meal breaks. This ensures that employees are not unfairly impacted during their designated break times.

-

Consistent application: Consistency is crucial. Employers should apply rounding rules uniformly to all employees and across all time periods to avoid favoritism or disputes.

-

No rounding for overtime hours: To maintain fairness, some businesses implement a rule that prevents rounding for overtime hours. Overtime is typically calculated based on actual minutes worked rather than rounded times.

-

Transparency and communication: Communicate rounding rules transparently to all employees. Ensure they understand how rounding works and why it is in place to avoid confusion or disputes.

-

Record detailed time: While rounding is applied for payroll calculations, maintain detailed records of actual clock-in and clock-out times. This information can be essential for resolving any disputes or discrepancies.

-

Compliance with labor laws: Ensure that rounding rules comply with labor laws, particularly the Fair Labor Standards Act (FLSA) or equivalent regulations in your region. Legal compliance is essential to avoid wage and hour grievances.

Useful Read: What Are the Time Clock Rules for Hourly Employees? A Guide

How to implement time clock rounding

Implementing time clock rounding in your business can be a systematic process. Here's a detailed step-by-step guide to help you adopt this practice:

Step 1. Choosing the rounding increment:

Begin by selecting the rounding increment that suits your business needs. The most common choice is rounding to the nearest quarter-hour (15-minute increments), but you can adjust it based on your preferences and employee agreements.

Step 2. Employee communication and training:

Communicate the introduction of time clock rounding to your employees clearly and transparently. Explain the reasons behind its implementation, emphasizing fairness and compliance with labor laws.

Conduct training sessions to ensure that employees understand how the rounding process works. Provide examples to illustrate how their clock-in and clock-out times will be rounded.

Step 3. Updating timekeeping systems:

Ensure that your timekeeping systems, whether manual or digital, are updated to accommodate Time clock rounding. If you use time clock software, work with your provider or IT department to configure it correctly.

Verify that your systems can accurately round employee time to the chosen increment. This step is crucial for precise payroll calculations.

Step 4. Consistent application of the rounding rules:

Establish and communicate a clear set of rounding rules that will be consistently applied across your organization. Ensure that all employees are aware of these rules.

Monitor and enforce the consistent application of these rules. Regularly review employee timesheets to check for compliance.

Tips for addressing common challenges in implementation

Implementing time clock rounding may encounter some common challenges. Here are some practical tips to address these issues:

-

Address wage and hour grievances promptly: If employees raise concerns or grievances related to their wages, address them promptly and transparently. Communicate the rounding rules and how they are being applied to resolve any misunderstandings.

-

Educate employees on break times: Clearly communicate your company's policy regarding unpaid meal breaks and how they should be recorded. Ensure that employees understand the importance of accurate timekeeping during breaks.

-

Implement good time tracking software: Invest in reliable time tracking software that can handle time clock rounding effectively. Good software can minimize errors and streamline the rounding process.

-

Monitor employee turnover: Keep an eye on employee turnover during and after the implementation of time clock rounding. Ensure that new hires are properly trained and informed about the practice.

-

Maintain accurate records: Keep detailed records of employee time, rounding calculations, and payroll adjustments. Accurate records are essential for compliance and transparency.

-

Minimize errors: Regularly review timesheets for errors or inconsistencies. Implement checks and balances to minimize rounding errors and ensure fairness.

By following these steps and tips, you can successfully implement time clock rounding in your business, ensuring compliance with legal requirements while simplifying your payroll process and promoting fairness in time tracking.

Legal considerations and compliance

When implementing time clock rounding in your business, it's crucial to understand and adhere to labor laws and regulations. Let's delve into the legal considerations and compliance aspects of this practice:

Importance of adhering to labor laws and regulations:

Adhering to labor laws and regulations is of paramount importance for businesses of all sizes. Failing to comply with these laws can result in legal disputes, financial penalties, and damage to your company's reputation. Here's why compliance matters:

-

Avoiding wage and hour violations: Labor laws, such as the Fair Labor Standards Act (FLSA) in the United States, mandate minimum wage, overtime pay, and other employment standards. Non-compliance can lead to wage and hour violations, resulting in costly penalties.

-

Preventing wage theft claims: When time tracking practices are not in accordance with the law, employees may feel their wages are being unjustly reduced. This can lead to wage theft claims, which can harm your business's reputation and finances.

-

Maintaining employee trust: Complying with labor laws helps maintain trust between employers and employees. When employees see that you are following legal guidelines, they are more likely to feel valued and respected in the workplace.

How time clock rounding can be legally compliant?

To ensure that your time clock rounding practices are legally compliant, consider the following insights:

-

Choose a legal rounding method: When implementing time clock rounding, select a method that is legally acceptable, such as rounding to the nearest quarter-hour (15-minute increments). This aligns with common legal standards.

-

Transparent communication: Clearly communicate the rounding rules to your employees, including how clock-in and clock-out times will be rounded. Transparency helps employees understand the process and reduces potential disputes.

-

Consistent application: Apply the rounding rules consistently across all employees and time periods. Avoid making exceptions or deviations from the established rounding method, as consistency is key to compliance.

-

Keep accurate records: Maintain accurate records of employee time, rounding calculations, and payroll adjustments. These records serve as evidence of compliance and can be crucial in case of legal disputes.

-

Regularly review and update: Periodically review your time clock rounding practices to ensure they remain compliant with any changes in labor laws or regulations. Stay informed about legal updates and adapt your policies accordingly.

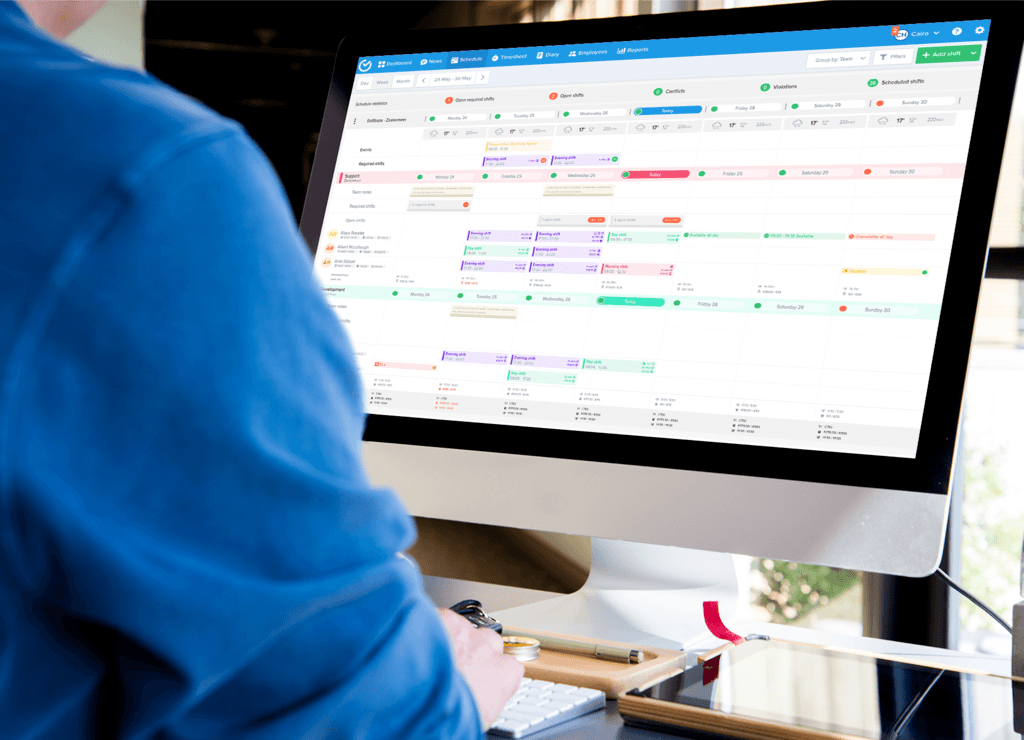

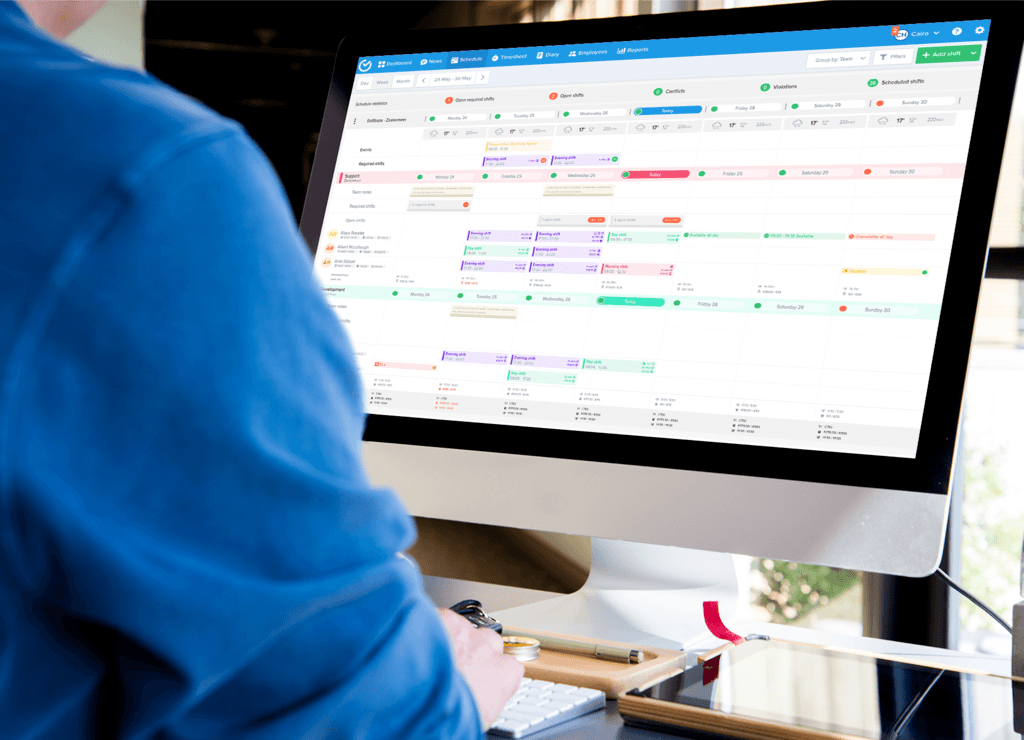

Tools and software for time clock rounding

Implementing time clock rounding in your business can be made easier and more efficient with the help of the right tools and software. Let's explore some time clock rounding software options and how technology can streamline the process:

Time clock software:

Time clock software is a versatile solution that allows employees to clock in and out digitally. It often includes rounding features, enabling you to round employee hours to the nearest quarter-hour or other designated increments.

This software provides real-time visibility into employee attendance, simplifies timesheet rounding, and automates the calculation of worked hours, reducing manual labor costs.

Payroll software:

Many payroll software solutions come equipped with time clock rounding capabilities. These systems integrate seamlessly with payroll calculations, making it easy to apply rounding rules and ensure compliance with federal laws.

Payroll software also helps maintain accurate records of employee hours, ensuring that wage and hour grievances are minimized.

Mobile time tracking apps:

Mobile time tracking apps allow employees to clock in and out using their smartphones or tablets. These apps often include rounding features that align with time clock rounding rules.

Such apps are particularly useful for businesses with remote or field-based employees, as they can track time and apply rounding rules from anywhere.

Web-based time and attendance systems:

Web-based time and attendance systems offer cloud-based solutions for time tracking and rounding. They provide flexibility and accessibility for both employers and employees.

These systems can enforce time clock rounding policies, track time accurately to the 10th of an hour, and generate reports for easy payroll calculations.

How technology can streamline the process?

Technology streamlines the time clock rounding process in several ways:

-

Automation: Rounding calculations can be automated, reducing the need for manual calculations. This automation ensures accuracy in rounding employee hours, minimizing errors in payroll.

-

Compliance checks: Many time clock rounding software options come with built-in compliance checks to ensure that rounding is legal and aligns with federal laws and regulations.

-

Integration: Time clock rounding software often integrates seamlessly with payroll systems, ensuring that rounded hours are accurately included in payroll calculations.

-

Accessibility: With mobile apps and web-based systems, employers and employees can access the time tracking and rounding features from anywhere, making it convenient for remote and on-the-go work situations.

-

Reporting: Technology allows for the generation of detailed reports, making it easier for businesses to maintain accurate records and demonstrate compliance with rounding policies.

Incorporating technology into your time clock rounding process can simplify time tracking, reduce labor costs, and ensure compliance with rounding rules and federal law. Choosing the right software for your business needs can lead to more efficient payroll processes and fewer wage and hour grievances.

Best practices for optimizing payroll efficiency

To ensure the smooth and efficient operation of your payroll process when using time clock rounding, consider implementing these best practices:

-

Consistent application of rounding methods: Maintain consistency in how rounding methods are applied to employees' clock-in and clock-out times. Avoid making exceptions, which can lead to confusion and discontent among employees.

-

Transparency in communication: Clearly communicate your rounding policies to all employees. Explain how rounding works, including the chosen rounding increment (e.g., nearest quarter-hour), to ensure everyone understands the process.

-

Regular monitoring of employee hours: Continuously monitor and review employee hours worked to identify any discrepancies or irregularities. Promptly address and correct any issues that arise.

-

Timely payroll calculations: Calculate payroll in a timely manner, adhering to your established pay periods. This ensures that employees receive their paychecks on schedule, contributing to their satisfaction.

-

Record keeping and documentation: Maintain accurate records of employee hours, rounding calculations, and payroll adjustments. Proper documentation is essential for resolving disputes and demonstrating compliance with legal requirements.

-

Training and education: Train HR personnel responsible for payroll calculations to understand time clock rounding rules thoroughly. Additionally, provide training to employees so they can accurately record their work hours.

-

Minimize errors: Implement checks and balances in your payroll process to minimize errors. Regularly review timesheets for rounding discrepancies and rectify them promptly.

-

Respond to employee concerns: Be responsive to employee concerns related to payroll or time tracking. Address any issues promptly and work towards a resolution to avoid having unhappy employees.

-

Educate employees about the importance of time clock rounding: Help employees understand why time clock rounding is important. Emphasize that it ensures fair and accurate compensation and helps maintain compliance with labor laws.

-

Stay informed about best practices: Keep up-to-date with the latest best practices for time clock rounding and payroll management. This continuous learning process can help your business stay efficient and compliant.

Easily manage your employees' hours worked!

Conclusion

Implementing tried-and-true timesheet rounding rules is a practical way to streamline your payroll process while ensuring fairness and compliance with labor laws.

By adopting straightforward rounding methods, maintaining transparency, and prioritizing accuracy, businesses can efficiently manage employee hours and payroll calculations.

These time-tested rules not only simplify administrative tasks but also contribute to a harmonious work environment where employees are fairly compensated for their time and efforts.

Enhancing payroll with Shiftbase's time clock rounding

Shiftbase's time tracking feature includes time clock rounding, streamlining payroll processes and ensuring fairness. With this tool, clock-in and clock-out times are adjusted for ease of calculation, simplifying payroll management. Along with employee scheduling and absence management, Shiftbase provides a comprehensive solution for efficient workforce management.

Experience these benefits by signing up for a 14-day free trial here.