What is the 7-minute time clock rule?

The 7-minute time clock rule is a time-tracking method that involves rounding employee hours to the nearest quarter-hour increment, as allowed by the Fair Labor Standards Act (FLSA).

This rule simplifies the timekeeping process by rounding employees' clock-in and clock-out times to the nearest 15-minute mark.

For example, if an employee clocks in at 8:07 AM, their time is rounded to 8:15 AM, and if they clock out at 5:23 PM, it's rounded to 5:30 PM. This rounding process ensures a fair and consistent approach to tracking employee time while complying with federal law.

How does the 7 minute clock rule work?

When rounding to the nearest 15-minute increment, the following guidelines apply:

Clock-In Times:

- If an employee clocks in between :01 and :07 minutes after the quarter-hour, the time is rounded down to the previous quarter-hour.

- If an employee clocks in between :08 and :14 minutes after the quarter-hour, the time is rounded up to the next quarter-hour.

Example: An employee clocks in at 8:05 AM; the time is rounded down to 8:00 AM. If they clock in at 8:10 AM, it is rounded up to 8:15 AM.

Clock-Out Times:

- If an employee clocks out between :01 and :07 minutes after the quarter-hour, the time is rounded down to the previous quarter-hour.

- If an employee clocks out between :08 and :14 minutes after the quarter-hour, the time is rounded up to the next quarter-hour.

Example: An employee clocks out at 5:07 PM; the time is rounded down to 5:00 PM. If they clock out at 5:10 PM, it is rounded up to 5:15 PM.

This practice, permitted under the Fair Labor Standards Act (FLSA), simplifies payroll processing while ensuring fairness. Below is a table illustrating how various clock-in and clock-out times are adjusted according to this rule:

| Actual Time |

Rounded Time |

Rounding Direction |

| 7:53 AM |

8:00 AM |

Up |

| 7:54 AM |

7:45 AM |

Down |

| 8:07 AM |

8:00 AM |

Down |

| 8:08 AM |

8:15 AM |

Up |

| 8:22 AM |

8:15 AM |

Down |

| 8:23 AM |

8:30 AM |

Up |

| 8:37 AM |

8:30 AM |

Down |

| 8:38 AM |

8:45 AM |

Up |

| 8:52 AM |

8:45 AM |

Down |

| 8:53 AM |

9:00 AM |

Up |

How to Interpret the Table:

- Clock-In/Out Between :53 and :07 Minutes Past the Hour: Rounded to the top of the hour.

- Clock-In/Out Between :08 and :22 Minutes Past the Hour: Rounded to the quarter-hour (:15).

- Clock-In/Out Between :23 and :37 Minutes Past the Hour: Rounded to the half-hour (:30).

- Clock-In/Out Between :38 and :52 Minutes Past the Hour: Rounded to the three-quarter hour (:45).

Key legal considerations

Implementing the 7-minute time clock rule requires careful consideration of various legal aspects to ensure compliance and fairness. Below is a comprehensive overview of the key legal considerations:

1. Fair Labor Standards Act (FLSA) Compliance

The FLSA permits employers to round employee work time to the nearest increment, such as 5, 6, or 15 minutes, provided that the rounding practice is neutral and does not consistently favor the employer or the employee. The U.S. Department of Labor emphasizes that rounding should average out so that employees are fully compensated for all the time they actually work.

2. Neutrality in Rounding Practices

Employers must ensure that their rounding policies do not systematically undercompensate employees. For instance, always rounding down can lead to wage underpayment, which violates FLSA regulations. The rounding system should be applied consistently and impartially to prevent any bias.

3. State-Specific Regulations

While the FLSA provides federal guidelines, individual states may have additional or more stringent laws regarding time rounding. For example, some states may prohibit rounding altogether or have specific requirements for how it should be implemented. Employers should consult state labor laws to ensure full compliance with both federal and state regulations.

4. Legal Precedents

Several court cases have shaped the legal landscape of time rounding practices:

-

Anderson v. Mt. Clemens Pottery Co. (1946): Established that employers cannot routinely round down employee time if it leads to wage underpayment.

-

Heppner v. Pepsi-Cola Bottling Co. (1999): Addressed the permissibility of rounding down for short breaks but not for longer ones.

-

Strickland v. City of Albany (2008): Highlighted issues with automated systems consistently rounding down, violating the FLSA’s neutrality requirement.

-

Houston v. St. Luke's Health System (2023): Challenged a hospital's practice of rounding punches down to the nearest quarter-hour, emphasizing that rounding must average out over time.

These cases underscore the necessity for organizations to maintain neutrality in rounding employee hours, avoiding systematic disadvantage.

Common employer concerns

Implementing the 7-minute time clock rule requires addressing several common concerns to ensure compliance and fairness. Below are detailed explanations to assist employers and managers:

1. How Does the 7-Minute Rule Impact Overtime Calculations?

The 7-minute rule allows employers to round employee clock-in and clock-out times to the nearest quarter-hour. While this simplifies timekeeping, it's crucial to ensure that rounding does not inadvertently affect overtime compensation.

According to the Fair Labor Standards Act (FLSA), employers must pay non-exempt employees overtime for hours worked over 40 in a workweek. Improper rounding that consistently undercounts actual work time can lead to unpaid overtime, resulting in legal violations.

For example, if an employee clocks in 10 minutes early and clocks out 7 minutes late each day, and the employer rounds time back to scheduled hours, the employee may end up working extra time without appropriate overtime compensation.

2. What Are the Best Practices for Implementing a Neutral Rounding System?

To establish a fair and compliant rounding system, consider the following best practices:

-

Consistency: Apply rounding rules uniformly across all employees to prevent discrimination or favoritism.

-

Neutrality: Ensure that the rounding policy does not consistently favor either the employer or the employee. The system should average out over time, compensating employees fairly for all hours worked.

-

Documentation: Clearly outline the rounding policy in the employee handbook, detailing how it works and its impact on pay. This transparency helps in setting clear expectations and reduces misunderstandings.

-

Training: Educate supervisors and payroll staff on correctly applying the rounding policy to maintain consistency and compliance. Proper training ensures that the policy is implemented as intended and reduces the risk of errors.

-

Regular Audits: Periodically review timekeeping records to ensure the rounding practice remains neutral and compliant with current laws. Audits can help identify and correct any unintended biases in the system.

3. How Can Employers Ensure Compliance with Both Federal and State Regulations?

While the FLSA provides federal guidelines permitting neutral rounding practices, state laws may impose additional requirements or restrictions. To ensure compliance:

-

Research State Laws: Investigate specific state regulations regarding time rounding, as some states have stricter rules or prohibit rounding altogether. For instance, Oregon explicitly prohibits automatic punch rounding.

-

Consult Legal Experts: Engage with legal professionals or human resources consultants knowledgeable in both federal and state labor laws to tailor your policies appropriately. This ensures that your rounding practices are legally sound and adapted to your jurisdiction.

-

Stay Informed: Regularly update your knowledge on labor laws, as regulations can change. Subscribing to updates from the Department of Labor or state labor agencies can be beneficial.

4. What Are the Potential Legal Risks of Improper Rounding Practices?

Improper implementation of rounding practices can lead to several legal risks:

-

Wage and Hour Violations: Consistently rounding down employee time can result in unpaid wages or overtime, violating the FLSA. Such practices can lead to legal actions and financial penalties.

-

Employee Lawsuits: Employees may file lawsuits for wage theft if they believe the rounding system unfairly reduces their pay. This can result in costly legal battles and damage to the company's reputation.

-

Regulatory Penalties: Non-compliance with federal or state labor laws can lead to investigations and fines from labor departments. Maintaining compliant practices helps avoid such penalties.

By addressing these concerns thoughtfully and implementing best practices, employers can utilize the 7-minute rule effectively, ensuring fair compensation and compliance with labor laws.

Rounding practices

In addition to the 7-minute rule, employers often implement various time clock rounding practices to streamline payroll processing and maintain consistency in timekeeping. These practices, when applied correctly, are permissible under the Fair Labor Standards Act (FLSA). Below are some common rounding methods:

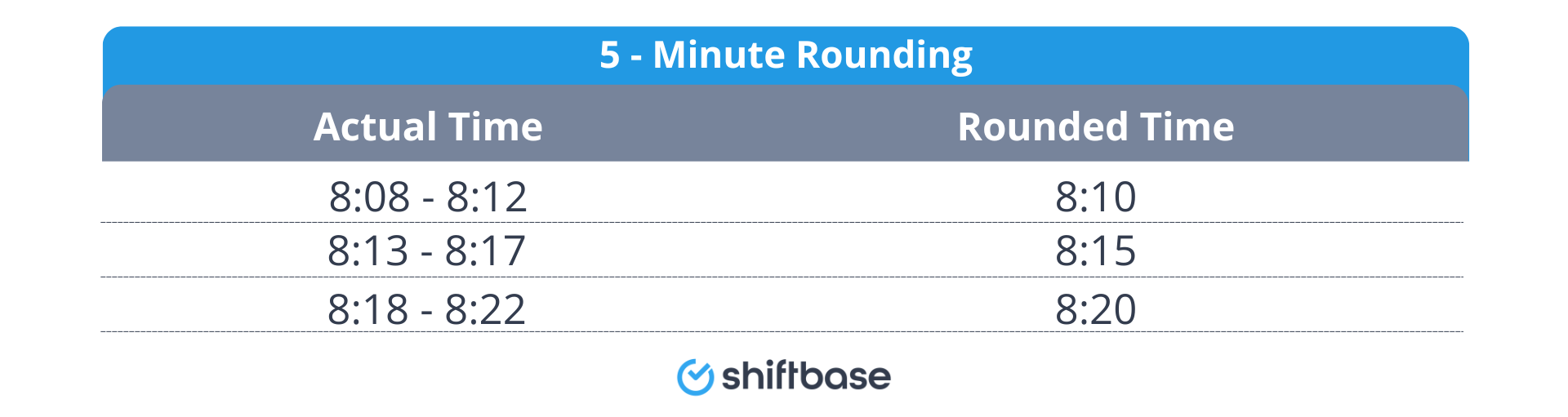

1. 5-Minute Rounding

This method rounds employee clock-in and clock-out times to the nearest 5-minute interval. The rounding process is as follows:

In 5-minute rounding, each 5-minute interval is split into two parts:

- First 2.5 minutes: Times are rounded down to the previous 5-minute mark.

- Second 2.5 minutes: Times are rounded up to the next 5-minute mark.

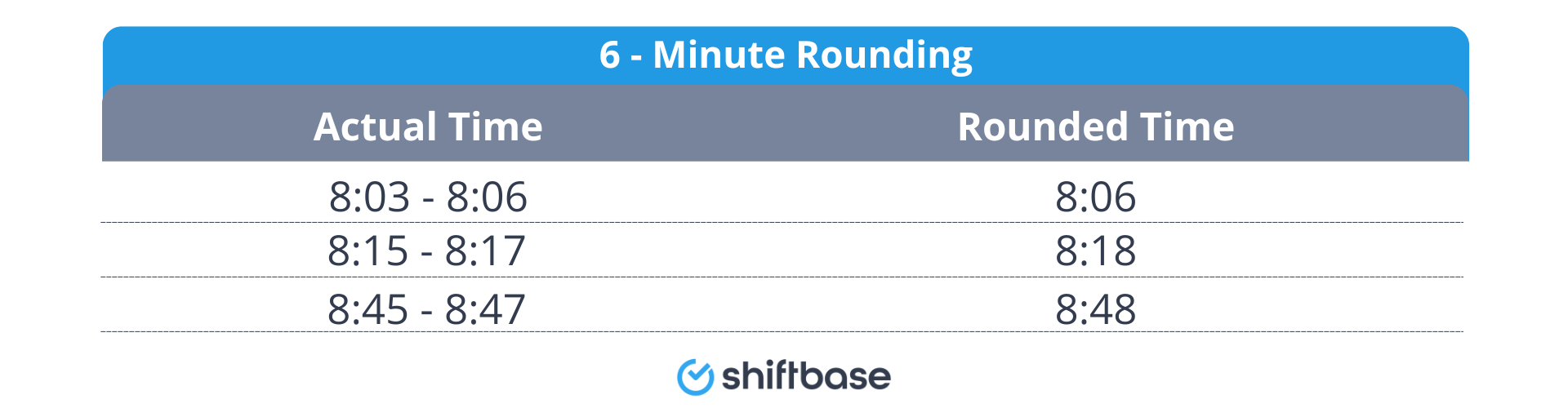

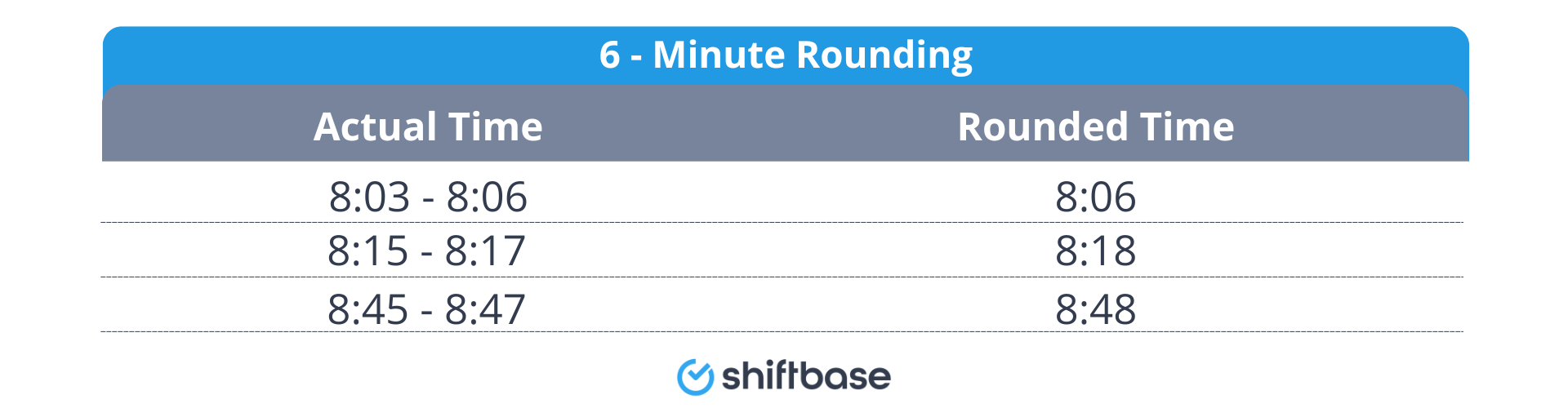

2. 6-Minute Rounding (Tenth-Hour Rounding)

In this approach, time is rounded to the nearest 6-minute increment, as there are ten such increments in an hour. The rounding works as follows:

- First 3 minutes: Times are rounded down to the previous 6-minute mark.

- Next 3 minutes: Times are rounded up to the next 6-minute mark.

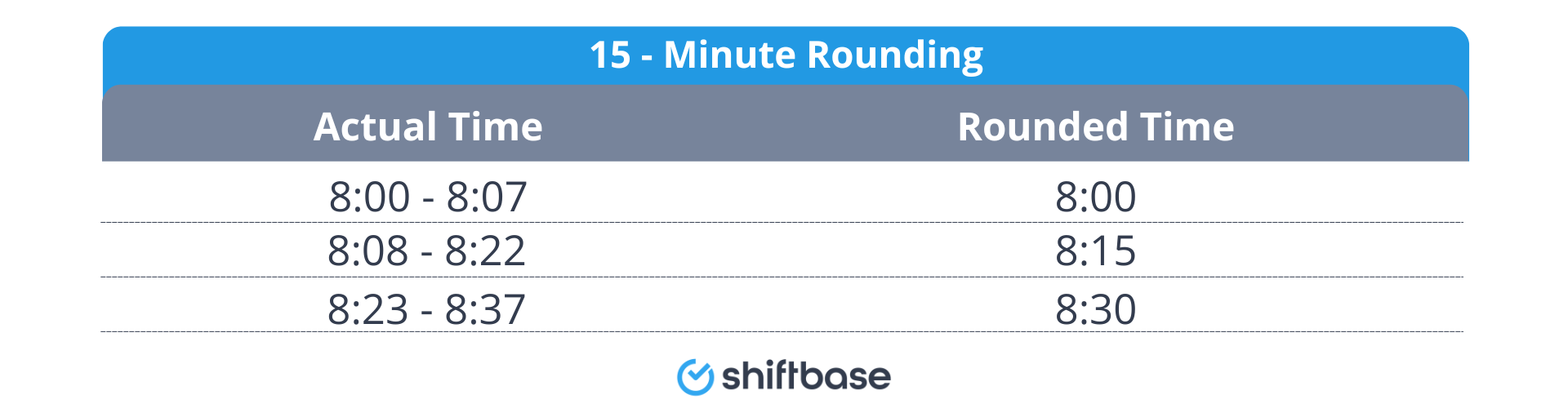

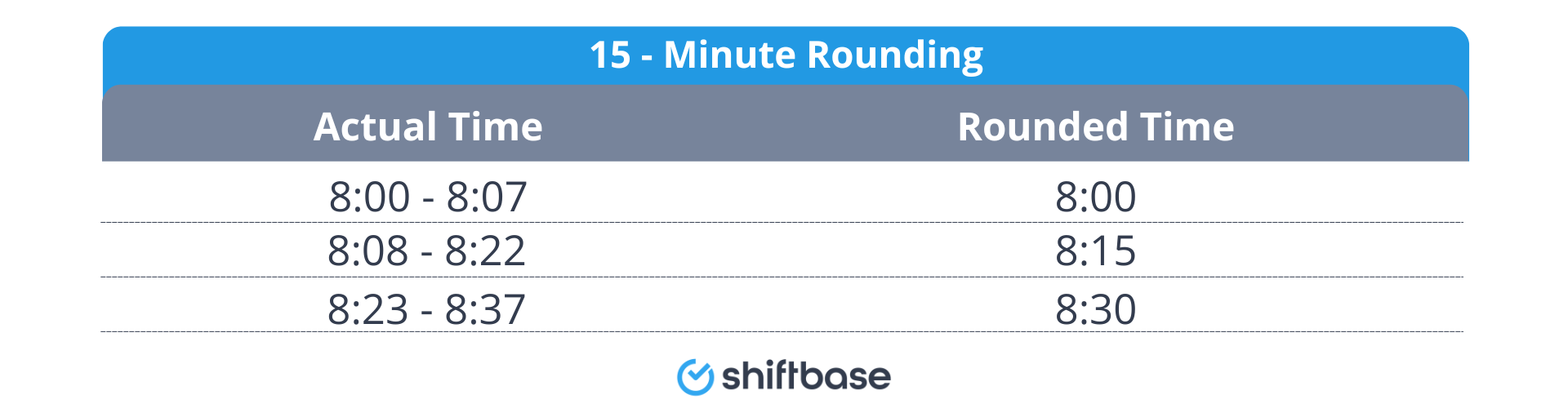

3. 15-Minute Rounding (Quarter-Hour Rounding)

This method rounds employee clock-in and clock-out times to the nearest 15-minute interval. It's often referred to as the "7-minute rule" because the breakpoint for rounding occurs at the 7-minute mark.

- First 7 minutes and 29 seconds: Times are rounded down to the previous quarter-hour.

- Next 7 minutes and 30 seconds: Times are rounded up to the next quarter-hour.

Best practices for implementing a neutral rounding system

Implementing a neutral rounding system for employee timekeeping is essential to ensure fairness, maintain compliance with labor laws, and foster trust within the workplace. Below are best practices to guide employers in establishing an effective and impartial rounding policy:

1. Develop a Clear and Consistent Rounding Policy

-

Documentation: Clearly outline the rounding rules in the employee handbook, specifying the rounding increments (e.g., 5, 10, or 15 minutes) and how they are applied.

-

Uniform Application: Apply the rounding policy consistently across all employees to prevent any perception of favoritism or discrimination.

2. Ensure Neutrality in Rounding Practices

-

Balanced Rounding: Implement a system that rounds time both up and down to the nearest increment, ensuring that, over time, employees are neither underpaid nor overpaid.

-

Regular Monitoring: Conduct periodic audits of time records to verify that the rounding practices do not systematically disadvantage employees.

3. Leverage Reliable Timekeeping Systems

-

Automated Solutions: Utilize time and attendance software that can accurately record work times and apply rounding rules automatically, reducing the risk of human error.

-

Accuracy: Ensure the chosen system captures precise clock-in and clock-out times before applying rounding, maintaining a transparent record of actual hours worked.

4. Train Supervisors and Payroll Staff

-

Policy Education: Provide comprehensive training to those responsible for timekeeping and payroll on the rounding policy and its correct application.

-

Issue Resolution: Equip staff to address any employee concerns or questions regarding the rounding system promptly and effectively.

5. Communicate Transparently with Employees

-

Policy Disclosure: Inform all employees about the rounding policy upon implementation and during onboarding, ensuring they understand how it affects their time records and compensation.

-

Feedback Mechanism: Establish channels through which employees can express concerns or provide feedback about the rounding system, promoting an open and trusting work environment.

6. Stay Informed About Legal Requirements

-

Federal Compliance: Adhere to the Fair Labor Standards Act (FLSA) guidelines, which permit rounding practices as long as they are neutral and do not consistently favor the employer.

-

State Regulations: Regularly review state-specific labor laws, as some states have additional requirements or prohibitions regarding time rounding.

7. Regularly Review and Update Policies

-

Continuous Improvement: Periodically assess the rounding policy's effectiveness and compliance, making adjustments as necessary to align with any changes in labor laws or organizational needs.

-

Employee Input: Consider employee feedback in policy reviews to identify potential areas for improvement and to enhance overall satisfaction.

By adhering to these best practices, employers can implement a neutral rounding system that simplifies payroll processing, ensures equitable compensation, and maintains compliance with legal standards.

Easily manage your employees' hours worked!

Conclusion

The 7-minute time clock rule offers a practical solution for employers to simplify the time clock rounding process while staying legal in compliance with the Department of Labor regulations.

This rule not only benefits hourly employees by ensuring accurate time tracking and overtime pay, but it also streamlines the timesheet rounding process, providing a fair and consistent way for employers to round time during each pay period.

Useful Read: What Are the Time Clock Rules for Hourly Employees? A Guide

Embracing the 7-minute rule enhances productivity, reduces stress, and fosters a harmonious work environment, ultimately benefiting both employers and employees alike.

Streamline with the 7-Minute Rule Using Shiftbase

Implement the efficient 7-minute time clock rule in your business with Shiftbase. This rule, supported by Shiftbase's time tracking feature, simplifies payroll calculations by rounding clock-in and clock-out times. Alongside, Shiftbase's employee scheduling and absence management tools enhance overall workforce management. This integration ensures accurate timekeeping and payroll efficiency, beneficial for both employers and employees.

Experience this efficiency firsthand by trying Shiftbase for free for 14 days. Sign up to transform your time management practices.