What is predictability pay?

Predictability pay ensures fairness in employee scheduling, offering compensation for last-minute changes in work shifts.

Defining predictability pay

Predictability pay is a compensation measure that employers must provide when an employee's schedule changes unexpectedly. This typically occurs when there is insufficient advance notice for a shift change, such as adding or canceling scheduled hours. For covered employees, this ensures that they are fairly compensated when their work schedules are altered under the employer's control. Predictability pay often includes additional hours of pay at the employee's regular rate or extra wages for on-call shifts or last-minute adjustments to the posted schedule.

Useful Read: On-Call Pay Explained: A Simple Guide for Employer

Why predictability pay is gaining traction

Predictability pay is becoming more common due to the rise of fair scheduling laws, such as the Fair Workweek Ordinance, which aims to provide employees with stable work hours and reduce last-minute shift changes. These laws particularly affect industries like retail, hospitality, and building services, where unpredictable demand leads to frequent adjustments in employee schedules. By implementing predictability pay laws, local governments are encouraging businesses to offer more stable work shifts, creating a better work-life balance for employees and minimizing the disruptions caused by sudden schedule changes.

How does predictability pay work?

Predictability pay helps ensure employees are compensated fairly when last-minute changes impact their work schedule.

Legal requirements for predictability pay

Predictability pay laws vary across jurisdictions, but they generally require employers to provide adequate advance notice for schedule changes. In many places, this means posting the employee's schedule at least 14 days in advance. If changes are made after that period, employers must pay extra compensation. These requirements often apply to covered employees in industries like retail, hospitality, healthcare, and building services, where unpredictable demand can lead to frequent changes in work schedules.

Employers must comply with local and state laws to avoid penalties. For instance, cities like San Francisco have adopted fair workweek ordinances that require employers to provide predictability pay for late schedule changes or canceled shifts. The amount of advance notice needed and the compensation required may differ depending on where the business operates.

How much employers must pay

The amount of predictability pay depends on how late the changes are made and the impact on the employee’s scheduled work hours. Employers must typically pay an additional hour of pay, or more, if a shift is canceled or significantly altered without enough notice. In some cases, on-call shifts or extra hours added at the last minute may require one-half times the employee's hourly rate for those hours. The exact pay premiums vary, but the goal is to provide fair compensation for the disruption caused by short-notice changes to an employee's schedule.

Benefits of predictability pay for employees and employers

Predictability pay offers significant advantages for both employees and employers, creating a more balanced and stable work environment.

Enhancing employee satisfaction and retention

Offering predictability pay can greatly improve employee satisfaction. When employees know they will be compensated fairly for schedule changes or additional hours, they feel more valued and secure in their roles. This leads to lower turnover, as workers are more likely to stay with employers who respect their time and provide predictable work schedules. Over time, this helps businesses build a more stable and reliable workforce, reducing the costs associated with constantly hiring and training new staff.

Promoting better work-life balance

Predictability pay allows employees to better plan their personal lives, knowing they won’t face unexpected changes to their scheduled hours without proper compensation. Whether it’s managing child care, planning social activities, or simply maintaining a healthy routine, a more predictable work schedule improves overall well-being. Employees experience less stress, leading to a better work-life balance and, as a result, they are more productive and satisfied at work.

Improving employer reputation

Employers that provide predictability pay demonstrate fairness and transparency in how they manage employee schedules. This not only improves relationships with current staff but also enhances the company’s reputation. Being known as a fair employer that prioritizes employee satisfaction can help attract top talent, as job seekers are increasingly looking for workplaces that value work-life balance and respect their employees' time. Adopting predictability pay can thus make a business more appealing to potential hires and improve its standing in the industry.

Industries most affected by predictability pay laws

Certain industries are especially impacted by predictability pay regulations due to their need for flexible staffing and fluctuating work hours.

Retail and hospitality

Retail and hospitality industries are heavily affected by predictability pay laws because of the constant shifts in demand. Stores and restaurants often adjust their work schedules based on customer flow, requiring employees to be available for on-call shifts or last-minute changes. As a result, employers must provide additional pay for affected employees when they alter posted schedules.

Healthcare and service industries

Healthcare and other service industries, including building services and security contractors, are also influenced by predictability pay laws. These sectors often rely on flexible staffing to meet varying patient or client needs, leading to frequent changes in work shifts. Predictability pay helps ensure that employees, including part-time workers, are compensated for any shift changes that occur without enough advance notice.

Gig economy and part-time workers

Gig workers and part-time employees in industries such as ride-sharing, delivery services, and financial institutions are increasingly affected by predictability pay laws. Since many gig roles involve inconsistent or on-demand hours, it can be challenging to provide a stable work schedule. However, predictability pay applies when there are last-minute changes or cancellations, giving these workers more security in their income.

Legal considerations and compliance for employers

Complying with predictability pay laws is essential for businesses to avoid legal risks and ensure fair treatment of employees.

Understanding local and state laws

Predictability pay laws vary significantly across different states and cities, making it crucial for employers to understand the specific requirements in their area. For instance, cities like San Francisco and New York have implemented fair workweek ordinances that require employers to provide advance notice of schedule changes, often at least 14 days. Local governments have introduced these laws to give employees more control over their work schedules, ensuring they aren’t subject to last-minute changes without compensation. Employers must regularly review local labor laws to remain compliant, as these regulations can differ widely based on where the business operates.

Avoiding legal penalties

Failing to comply with predictability pay laws can lead to substantial legal penalties, including fines or lawsuits. Employers who do not provide adequate notice of schedule changes or on-call shifts risk violating labor laws, which can result in costly legal action. These penalties are especially common in industries like retail, hospitality, and healthcare, where unpredictable work schedules are frequent. To avoid these risks, businesses must ensure that they meet all requirements related to predictability pay and provide compensation for last-minute changes as mandated by law.

Challenges of implementing predictability pay

Implementing predictability pay comes with its own set of challenges, especially for businesses managing fluctuating work schedules.

Scheduling flexibility vs. predictability

One of the main challenges businesses face is balancing the need for flexible scheduling with the strict requirements of predictability pay laws. Many industries, particularly retail and healthcare, rely on flexible work schedules to meet changing demands. However, predictability pay laws require employers to provide advance notice of schedule changes or face additional costs. This can limit a business's ability to quickly adapt to fluctuations, as last-minute shift changes or on-call hours may trigger extra pay. Employers must carefully plan work schedules to avoid unnecessary costs while still maintaining the flexibility they need to operate effectively.

Financial impact on businesses

The financial burden of predictability pay can be significant, particularly for small and medium-sized companies. When employers must pay additional wages for canceled shifts or late schedule changes, it can strain their budgets, especially if last-minute adjustments are common. Costs associated with providing predictability pay for on-call shifts or adding extra hours to an employee's schedule can quickly add up, making it essential for businesses to minimize schedule changes. For some employers, this can lead to increased labor costs and reduced profitability.

Tools and software to help manage predictability pay

Technology plays a vital role in helping businesses efficiently manage predictability pay and stay compliant with labor laws.

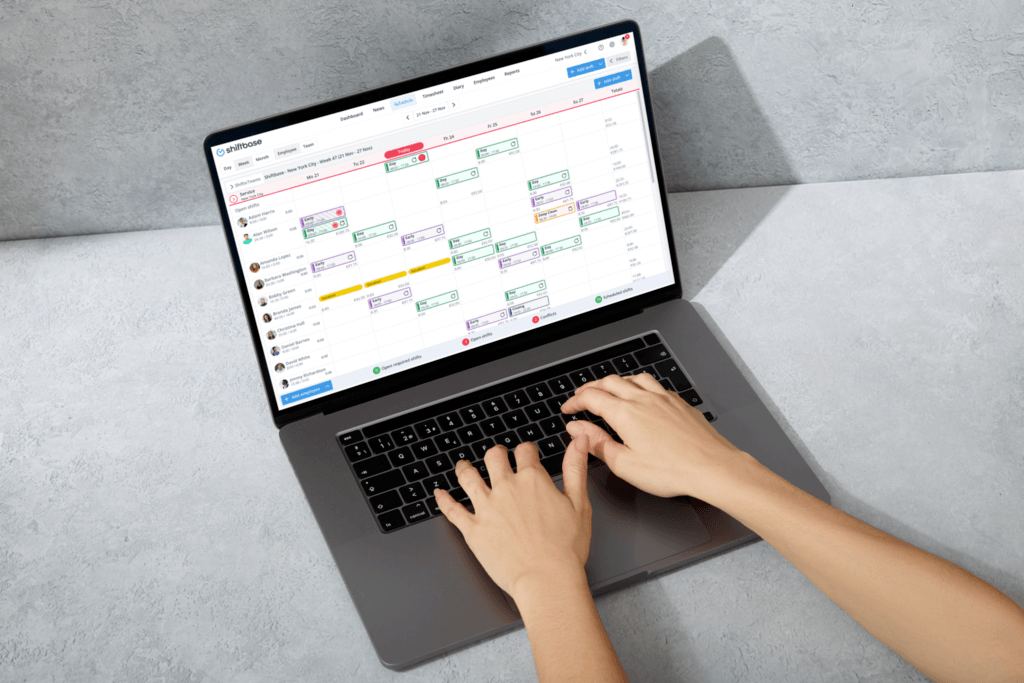

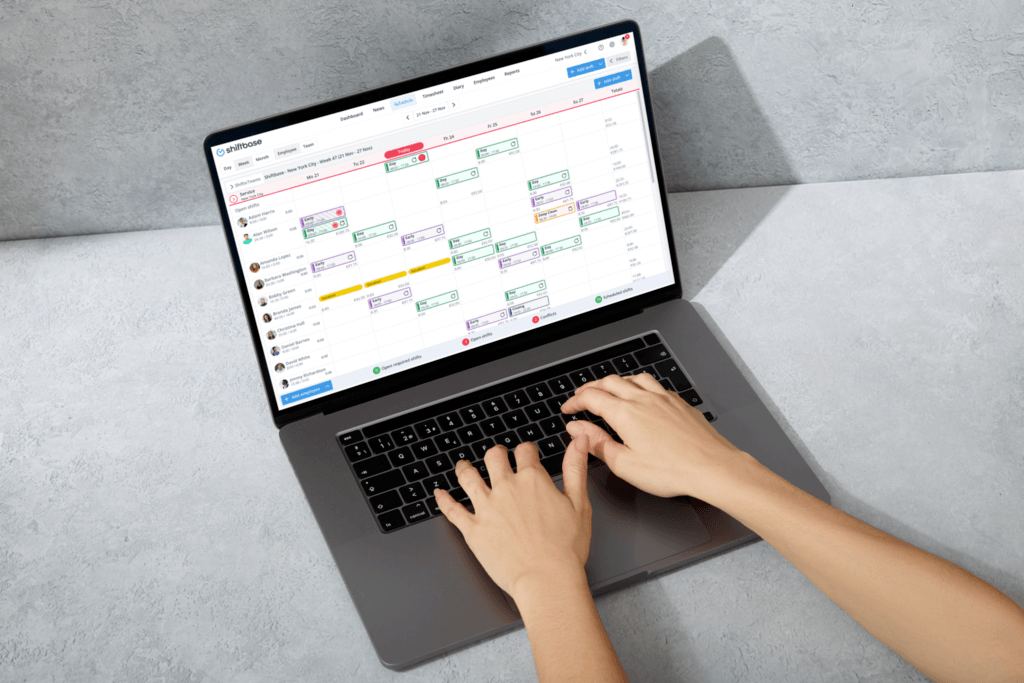

Workforce management platforms

Workforce management platforms offer powerful solutions for businesses to optimize their scheduling processes while complying with predictability pay laws. These platforms allow employers to plan work schedules in advance, ensuring that shifts are posted and adjusted with enough notice to avoid penalties. Additionally, they can track employee hours, provide visibility into scheduling needs, and help businesses avoid the last-minute changes that trigger extra pay. By using these tools, employers can maintain better control over employee schedules while ensuring they meet the legal requirements of predictability pay.

Real-time shift changes and notifications

One of the key features of workforce management tools is the ability to send real-time notifications for shift changes. This feature allows employers to communicate scheduling changes directly to employees, reducing confusion and minimizing the risk of last-minute adjustments. By providing immediate updates, businesses can address shift changes promptly and ensure that employees are aware of any modifications to their scheduled hours. This reduces the likelihood of triggering predictability pay, as changes are managed in a more timely and efficient manner.

Automating payroll calculations for predictability pay

Workforce management software can also automate the process of calculating predictability pay, ensuring that employees are compensated correctly and in compliance with local labor laws. These platforms can automatically apply pay premiums for canceled shifts, on-call hours, or other schedule changes, saving businesses time and reducing the risk of errors. By automating payroll processes, employers can ensure that employees receive the correct amount of additional pay without the need for manual calculations, streamlining the entire process and helping businesses avoid legal penalties.

Employee scheduling and Time-tracking software!